PCS Global is a trusted offshore accounting partner for Australian-based Businesses, Accounting Firms, SME’s and Consultants. Specializing in book-keeping, BAS preparation, payroll, strata and property management accounting, and financial reporting, we deliver accurate, Australian accounting standards-compliant solutions that boost efficiency and lower operational costs. Leveraging advanced cloud-based tools and a dedicated team, PCS Global ensures seamless integration with your existing workflows, acting as an extension of your in-house finance team.

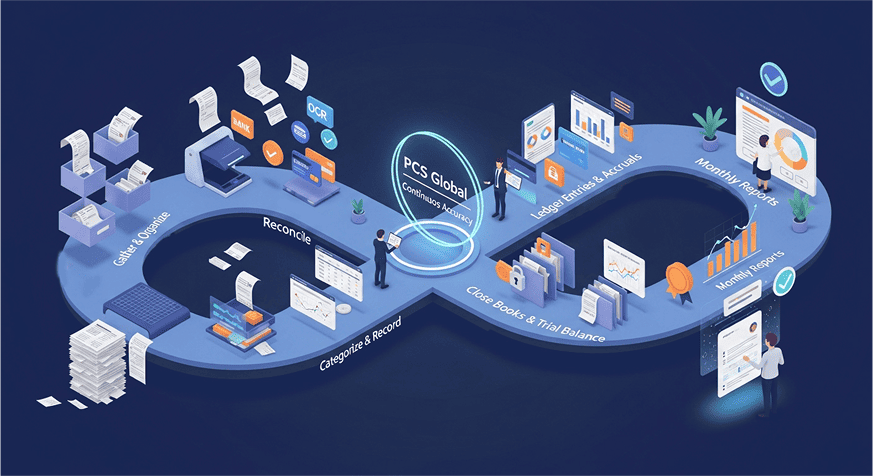

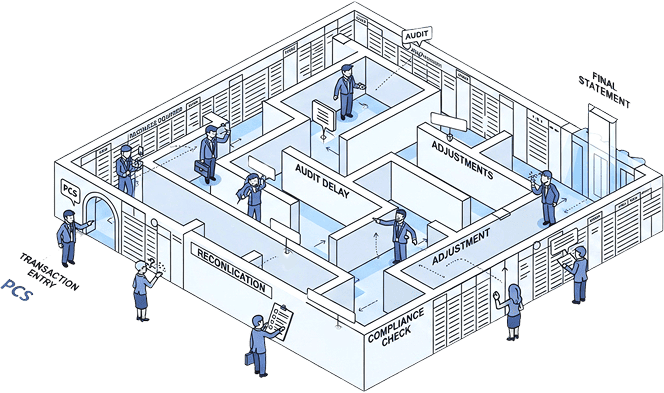

PCS Global provides encyclopedic book-keeping services, keeping your records true, tidy, and current. Our services include transaction entry, regular maintenance of the ledger or journal, and producing clear, meaningful financial reports tailored to your business needs. Whether you’re a small business or scaling, we ensure every transaction is recorded accurately and in compliance. With PCS Global managing your books, you’re free to concentrate on growing your business while we provide trustworthy and professional financial management.

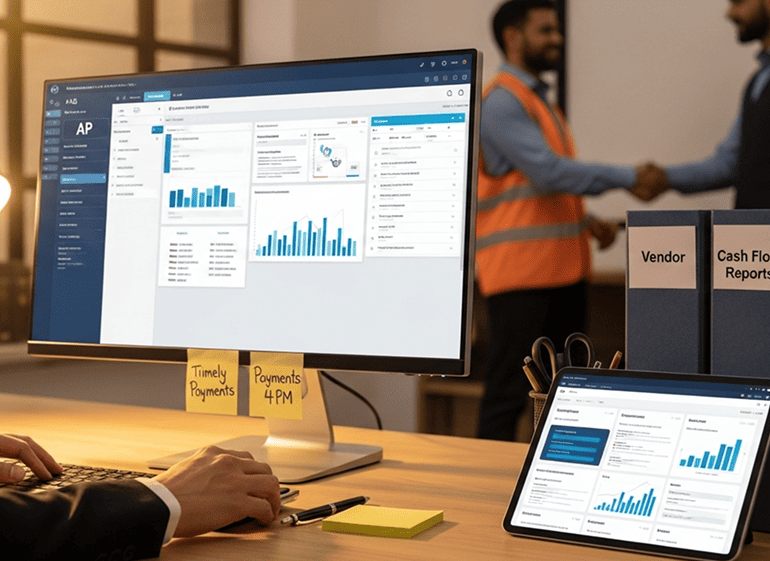

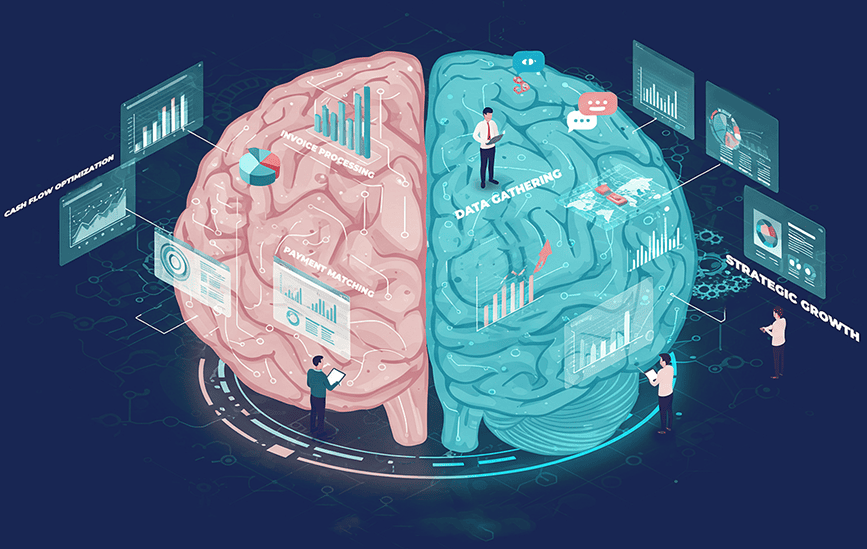

When you outsource your Accounts Payable to PCS Global, we simplify and enhance the management of your payables cycle, improve your relationships with your vendors, improve cash flow, and create clear action-ready reports for senior managers. We optimize accuracy and timeliness, and provide strong internal controls, allowing you to focus on the strategic growth of your organization.

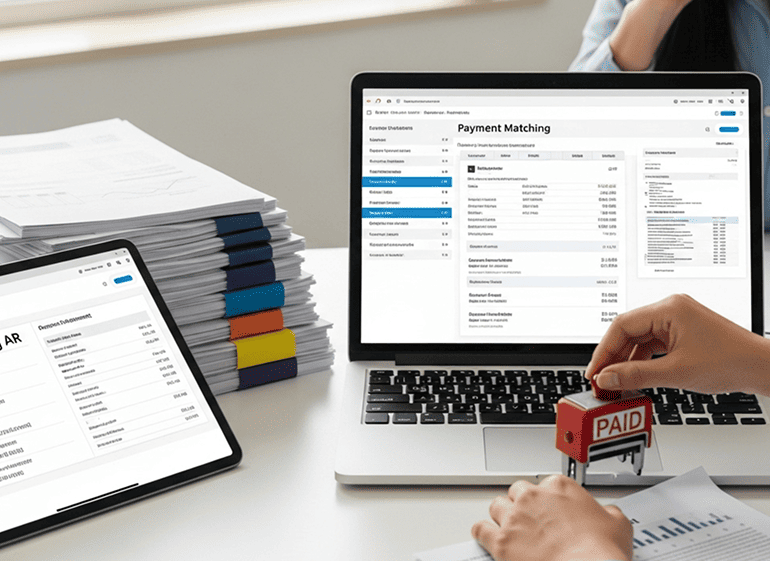

Efficient management of accounts receivable means cash continues to flow and customers maintain their goodwill. PCS Global automates invoice generation, reconciles payments, provides targeted reminders to minimize overdue balances, and runs credit checks to minimize bad debt. If you have a backlog of back-office operations, we can readily restore audit-ready financial clarity with our clean-up and reconciliation services.

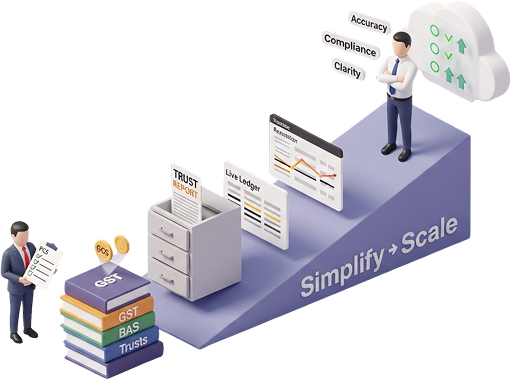

Monthly/Quarterly scrutiny of tax-code-wise general ledgers, rectification of incorrect GST transactions, preparation of BAS computation & lodgment, forecasting of BAS liability before end of BAS period for future fund management, payment lodgment of BAS liability, and reconciliation of ATO's integrated client account statement.

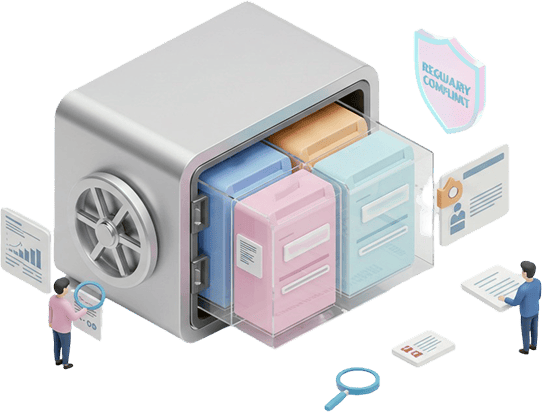

We help businesses prepare clear, accurate & fully compliant financial statements in line with Australian Accounting Standards (AASB) & regulations set by ASIC and the ATO. Regardless you are a sole trader, partnership, trust, or company, our approach is tailored to your specific business structure and reporting requirements. From the Profit & Loss Statement & Balance Sheet to the Cash Flow and Equity Statement, we make sure each element reflects a true and fair view of your financial position.

PCS Global is an expert in providing customized budgeting & forecasting solutions to help Australian businesses plan effectively & adapt quickly. By integrating financial planning with your strategic goals, we assist you in anticipating market shifts, managing cash flow & making informed decisions. Our services are intended to provide clarity and control, ensuring that your business remains resilient and growth-oriented in a volatile economic environment.

We offer specialised trust accounting services that comply with Australian regulations, ensuring transparency, accuracy, and accountability in managing trust funds. Whether you’re handling family trusts, unit trusts, or discretionary trusts, we maintain meticulous records of income, expenses, distributions, and beneficiary entitlements. Our service includes regular reconciliations, compliance with trust deeds and tax obligations, and preparation of year-end financial reports. With our support, trustees can focus on their fiduciary duties with confidence and clarity.

We deliver end-to-end payroll solutions tailored to Australian businesses, ensuring your team is paid accurately and on time while meeting all legislative requirements. From setting up employee pay classifications and managing leave accruals to calculating PAYG withholding and superannuation guarantee contributions, our process is seamless and compliant. We handle Single Touch Payroll (STP) reporting directly to the ATO, generate clear payslips, and reconcile payroll liabilities each period, freeing you to focus on your people, not paperwork. With our human-centred approach, we’re here to answer questions, adapt to your business needs, and guarantee peace of mind throughout every pay run.

We provide end-to-end SMSF services designed to empower trustees with full control over their retirement savings while ensuring strict ATO compliance. From initial setup and trust deed review to ongoing administration, our team handles the annual financial statements, tax returns, audit coordination, and ASIC reporting on your behalf. We partner with you to develop a bespoke investment strategy, monitor compliance within the fund’s investment strategy, and deliver clear, jargon-free guidance at every step. With proactive alerts for contribution caps and regulatory changes, you can stay confident that your fund is both optimized for growth and fully aligned with superannuation laws.

Our team is highly knowledgeable in Australian strata laws and accounting standards, ensuring your property remains legally compliant.

We maintain open communication and provide regular, clear financial reporting to support decision-making.

We tailor our services to suit the specific needs and goals of each property.

Our experienced professionals are committed to delivering prompt, reliable service for a smooth-running strata scheme.

Real Accuracy. Real People. Real-Time Reporting.