Strata living has become a major part of modern Australia—apartments, townhouses, mixed-use complexes, lifestyle communities—many of them operate under a strata scheme (or “body corporate / owners corporation / strata company,” depending on the state). When it works well, strata creates convenience, shared amenities, and long-term property value. When it doesn’t, owners face delayed maintenance, levy confusion, disputes, and poor decision-making that can drag on for years.

That’s why strata management in Australia is not just “admin support.” It’s a structured service that helps a scheme stay compliant, financially stable, and properly maintained—while guiding committees and owners through processes that often become legally sensitive. Because legislation is state-based, the best approach in 2026 is not to find a one-size-fits-all manager, but to choose a provider with strong systems and local compliance knowledge.

In this selection guide, we’ll cover what strata management is, how it differs across Australian states, why owners choose professional support, what criteria matter most in 2026, which questions to ask, and what risks/red flags to avoid—so you can make a confident, practical decision.

What Is Strata Management?

Strata management refers to the administration of a strata scheme’s shared governance and common property obligations. The owners collectively form the scheme’s legal entity—such as an owners corporation (VIC), body corporate (QLD), owners corporation (NSW), strata company (WA), or strata corporation (SA). A strata manager is usually engaged under contract to perform specific functions, often under delegated authority.

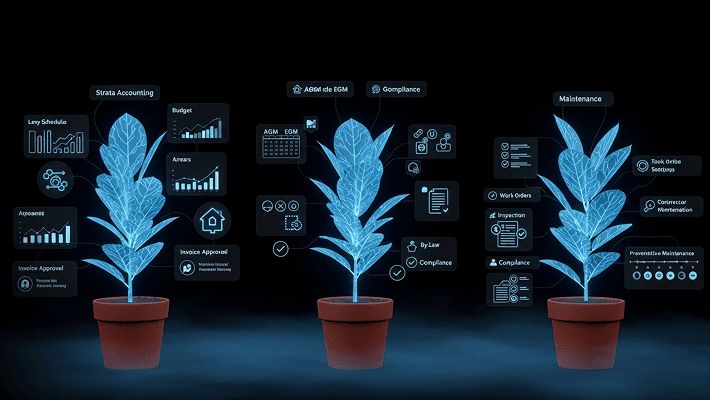

In practical terms, strata managers handle (or support) tasks like:

- Organising meetings (AGMs/EGMs), agendas, notices, minutes

- Maintaining records, registers, correspondence, contracts

- Levy administration, arrears follow-ups, invoice processing

- Budget preparation and Strata Accounting reports

- Coordinating maintenance, quotes, repairs, contractor access

- Supporting Strata Compliance processes and by-law administration

- Helping committees follow correct governance steps in disputes

A key point for 2026: the strata manager does not replace the committee. The committee and owners make decisions through lawful resolutions. The manager supports execution and compliance with agreed processes, contract scope, and relevant legislation.

See Also: America’s Best Property Management Company

Strata Management in the Australian Context

Australia’s strata environment is heavily shaped by:

- State-based legislation

- Rising expectations for transparency and governance

- Increased complexity in insurance, maintenance, contractor management, and compliance

- Technology adoption and demand for a Virtual Strata Manager experience (online records, approvals, reporting access, digital communication)

Today, owners don’t just want a manager who “keeps things moving.” They want:

- Clean and understandable financial reporting

- Predictable maintenance workflows

- Faster responses

- Better record access

- Stronger accountability and reduced conflicts of interest

That’s why the role of strata management companies in Australia is increasingly judged by systems rather than marketing.

Key Differences Across States (NSW, VIC, QLD, WA, SA)

If you’re selecting the right strata management company, state knowledge is not optional, it’s essential.

NSW (New South Wales)

NSW strata schemes operate under a clear statutory framework. Strata managing agents are commonly appointed by the owners corporation, and NSW also provides tribunal pathways in serious dysfunction, including appointment orders in some cases.

What to watch in NSW (2026):

- Record keeping, meeting procedure accuracy

- Clear scope/authority in agreements

- Transparent levy admin and reporting

VIC (Victoria)

Victoria uses the term owners corporation manager. Consumer Affairs Victoria outlines how managers are appointed and what their role can include, and it also stresses contract and governance requirements.

What to watch in VIC:

- Disclosure expectations and fee transparency

- Reporting and record access

- Contract clarity and performance expectations

QLD (Queensland)

Queensland uses body corporate manager terminology. A critical difference: Queensland Government guidance states a body corporate is not legally required to engage a manager, and that body corporate managers currently do not need to be licensed in Queensland (as per that official guidance).

What to watch in QLD:

- Strong due diligence on competence and systems

- Clear service standards and reporting capability

- Disbursement and “extras” clarity in pricing

WA (Western Australia)

WA uses strata company and strata manager terms. Landgate provides guidance on strata managers, including contract-based duties and legal requirements (including education-related requirements and checks).

What to watch in WA:

- Contract terms and delegated powers

- Financial processes and audit-ready reporting

- Maintenance workflows and quote governance

SA (South Australia)

SA uses strata corporation. Appointment processes and meeting procedure compliance are key, as are contract clarity and transparency.

What to watch in SA:

- Manager appointment process correctness

- Documentation quality and meeting records

- Transparent fee schedules

Read More: Strata Management Services for Smooth Operations

Top Reasons Property Owners Need Professional Strata Management

While some schemes self-manage successfully, many engage professionals because:

1. Strata Compliance is complex and risky

Meeting errors, incorrect notices, poor records, or non-compliant decision pathways can trigger disputes and weaken the scheme’s legal footing. Professional managers help reduce governance mistakes.

2. Financial clarity matters more than ever

Owners demand transparency. A good manager strengthens Strata Accounting, prepares budgets, tracks levies and arrears, and produces reports that owners can actually understand.

3. Maintenance affects property value

Common property deterioration (leaks, lifts, fire systems, roofs, structural issues) can become exponentially more expensive if delayed. Managers coordinate maintenance planning and contractor oversight.

4. Community living needs structure

Disputes happen: noise, parking, pets, renovations, by-laws. While managers are not “judges,” they support process, documentation, and escalation pathways.

5. Committees are time-poor

Even a simple scheme requires continuous admin—minutes, invoices, quotes, compliance tasks, communication. Outsourcing can protect volunteers from burnout.

These become the most visible benefits of hiring a strata management company: less confusion, better maintenance, and cleaner governance.

Key Criteria to Evaluate a Strata Management Company in 2026

Here’s what matters most in 2026 when choosing a reliable strata management company in Australia:

1. Contract scope and delegated authority clarity

Your agreement should clearly define:

- what they do

- what they don’t do

- what requires committee approval

- response expectations

- termination/data handover terms

2. Strata Accounting quality (not just “bookkeeping”)

Ask for sample (redacted) reports:

- budget format

- levy schedules

- arrears report style

- invoice approval workflow

- reconciliations and transparency practices

3. Maintenance workflow discipline

A reliable manager will have:

- ticketing/work order processes

- quote comparison frameworks

- contractor performance tracking

- clear emergency protocols

- preventative maintenance planning

4. Technology: Virtual Strata Manager capability

In 2026, owners expect digital access:

- online records and minutes

- levy statements and reports

- approvals and forms

- maintenance tracking

- communication history

5. Transparency and conflict-of-interest controls

Fee disclosure culture is a major quality signal. If a company can’t clearly explain commissions, referral arrangements, or contractor benefits—walk away.

6. Local legislation knowledge (by your state)

Even a great operator can fail if they don’t understand your state’s meeting rules, documentation requirements, and governance expectations.

Essential Questions to Ask Before Hiring

Use these questions during evaluation (and ask every provider the same set):

- What is included in your base fee? What’s charged as extras?

- Do you charge for meetings, minutes, and follow-up? If yes, how much?

- How do you manage contractor procurement? Any commissions or referral benefits?

- What is your response time standard for emails, emergencies, and maintenance?

- Can you show sample Strata Accounting reports and a meeting pack?

- What tech platform do you use? Can owners self-serve records?

- Who is the assigned manager—and what’s your backup coverage model?

- How do you handle arrears and levy collection sensitively but firmly?

- What’s the exit process if we change managers? Data handover? Notice period?

Common Red Flags to Avoid (Risk Section)

This is the part most owners wish they read earlier. If you see these patterns, you’re likely walking into service pain.

Red flag 1: “Cheap base fee” but unclear extras

A low management fee can be offset by charges for every small action—copies, emails, meeting attendance, contractor coordination, portal fees, and administrative add-ons.

Risk: owners feel trapped and distrust grows.

Red flag 2: Vague contract scope

If the contract reads like marketing (“full service strata solutions”) without detail on inclusions/exclusions and delegated authority, you can expect confusion later.

Risk: disputes over what the manager should be doing.

Red flag 3: Weak reporting and unclear Strata Accounting

If reports are inconsistent, hard to understand, or delayed, that’s a sign of poor systems.

Risk: levy increases, arrears problems, and committee conflict.

Red flag 4: No transparent disclosure culture

If a company gets defensive when asked about commissions, preferred suppliers, or referral arrangements, that’s a governance risk.

Risk: owners lose trust and assume decisions are not in their best interest.

Red flag 5: Poor records access and outdated tools

If owners can’t access minutes, financials, by-laws, and quotes efficiently, it increases friction and complaints.

Risk: slow decision-making and constant misunderstandings.

Red flag 6: High manager turnover

You keep re-explaining your building. Issues slip through gaps.

Risk: higher maintenance costs and reduced accountability.

Cost Breakdown: Strata Management Fees in Australia (2026)

Fees vary based on:

- number of lots

- facilities (lifts, pools, gyms)

- maintenance intensity

- state regulations

- reporting complexity

- included services vs disbursements

Most strata management fees are structured as:

- Base management fee

- Disbursements / incidentals (printing, postage, portal, meeting costs)

Indicative published examples include:

- SA estimates around $15–$35 per unit per month depending on scope

- VIC published estimate around $300–$500 per lot average (varies widely)

- NSW scheme-level example for a 52-lot building cited $10,000–$28,000/year base management fee range (varies by contract)

Important note: These are indicative references—real pricing depends on inclusions. Always compare quotes “like-for-like.”

Tips to Improve the Selection Process

To improve outcomes when selecting the right strata management company:

- Create a one-page scheme brief (lot count, facilities, major issues, arrears, known defects).

- Request quotes against the same scope so comparisons are fair.

- Ask for sample reports and meeting packs (redacted).

- Insist on transparency about benefits/commissions and contractor relationships.

- Interview the actual manager who will handle your scheme.

- Test the portal/demo to judge Virtual Strata Manager capability.

- Check the exit clause—data handover, notice period, record transfer.